Car insurance

Improving Incident Response with Telematics: A Success Story

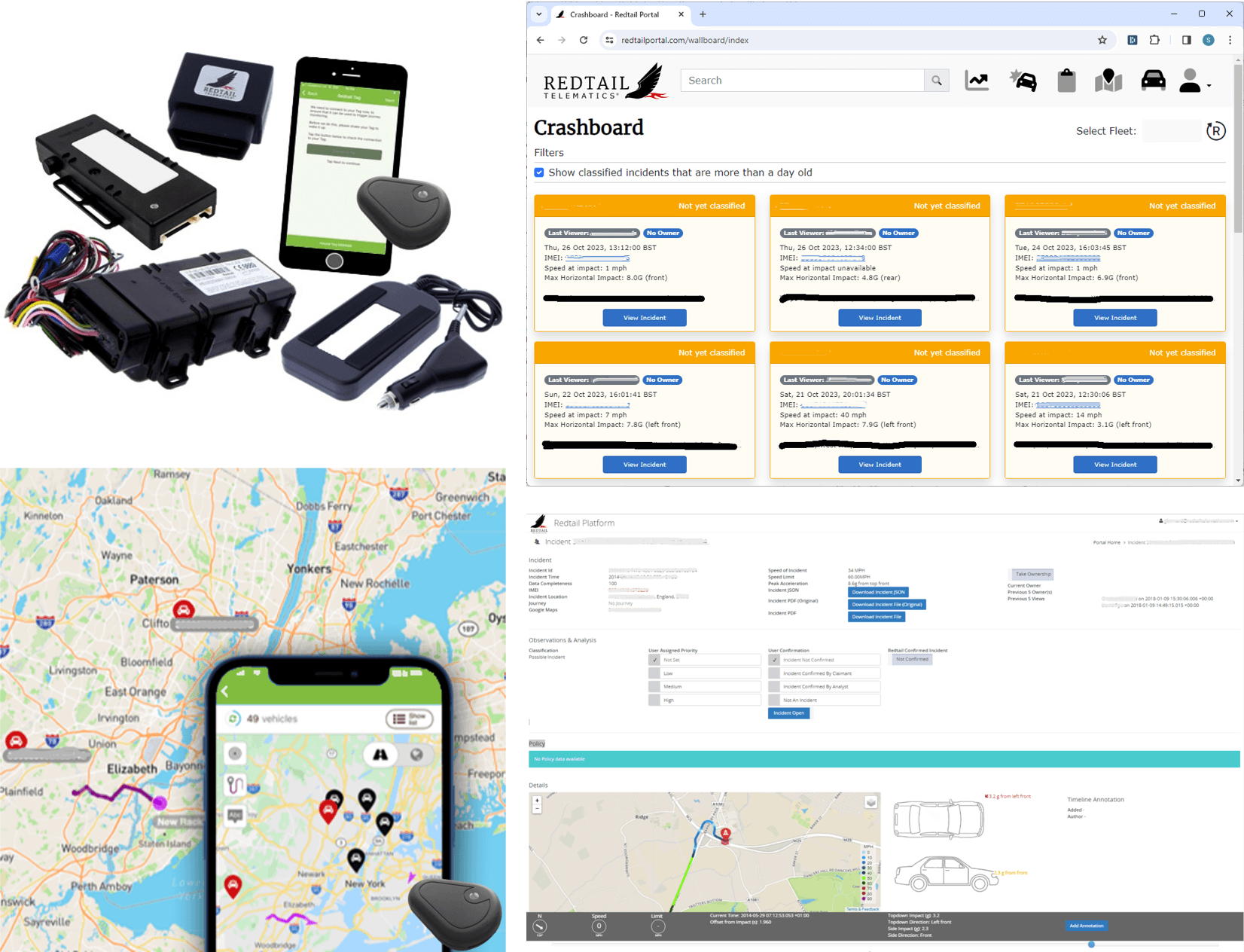

How REDTAIL provides insightful telematics data for FNOL detection can assist claims handlers with establishing key information when processing a claim.

Richard Jonas

We recently worked with a large UK insurer that manages tens of thousands of telematics devices. Their main goal was to detect and handle incidents as soon as they happened, without disrupting the well-established processes they rely on to manage claims. Here’s how we helped them achieve that.

First Notification of Loss (FNOL)

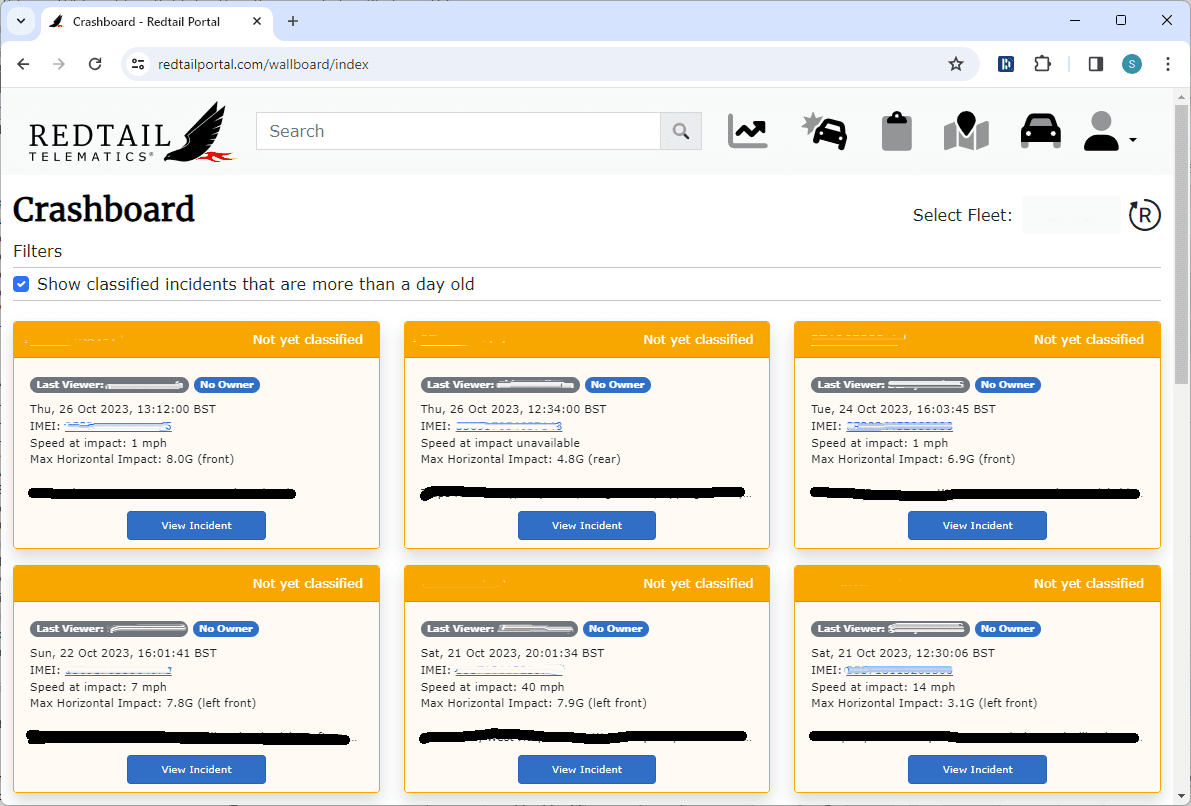

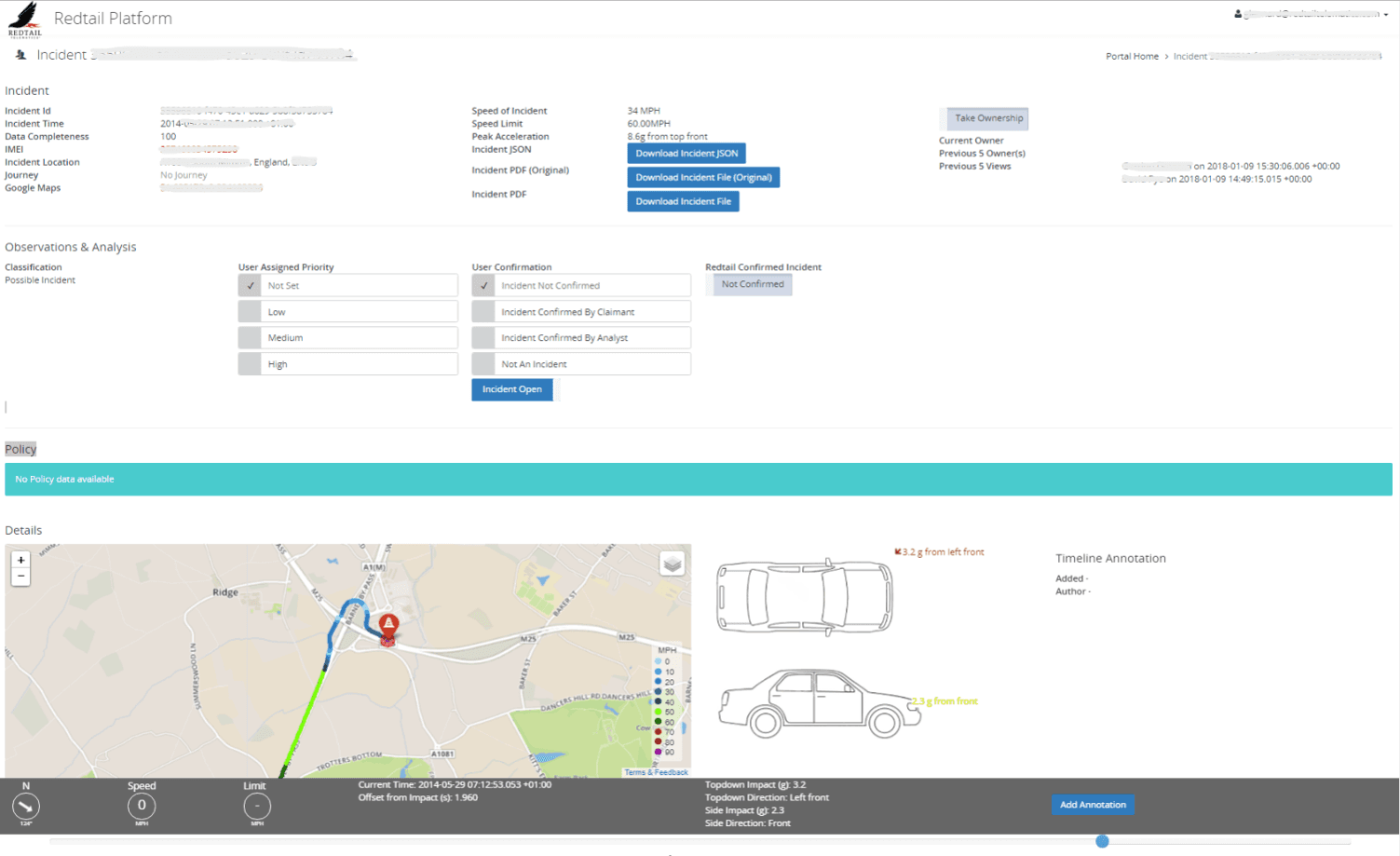

Firstly, we tackled immediate incident detection, otherwise known as First Notification of Loss (FNOL). Instead of waiting for drivers or third parties to report a collision, our system now flags incidents in real time. We fine-tuned our algorithms to recognise sudden changes in speed, direction, or impact. The insurer had been missing early alerts for some incidents and receiving false alarms for others. Working together, we collected feedback on every misclassification and used this data to teach the system how to become more accurate over time.

Telematics Claims Data

Next, we focused on providing the right context to support fast decisions. Insurers often spend valuable time asking drivers for details they might not recall perfectly. By pulling data from the vehicle’s sensors, we could show the insurer whether the driver was following policy guidelines, such as not using a vehicle for business use unless insured for it. We also added weather data, so it was clear whether glare from the sun or slippery road conditions could have played a part. Finally, we made sure the information about the telematics device itself was included, so the insurer could be certain it had been working normally at the time of the incident.

Dashboards

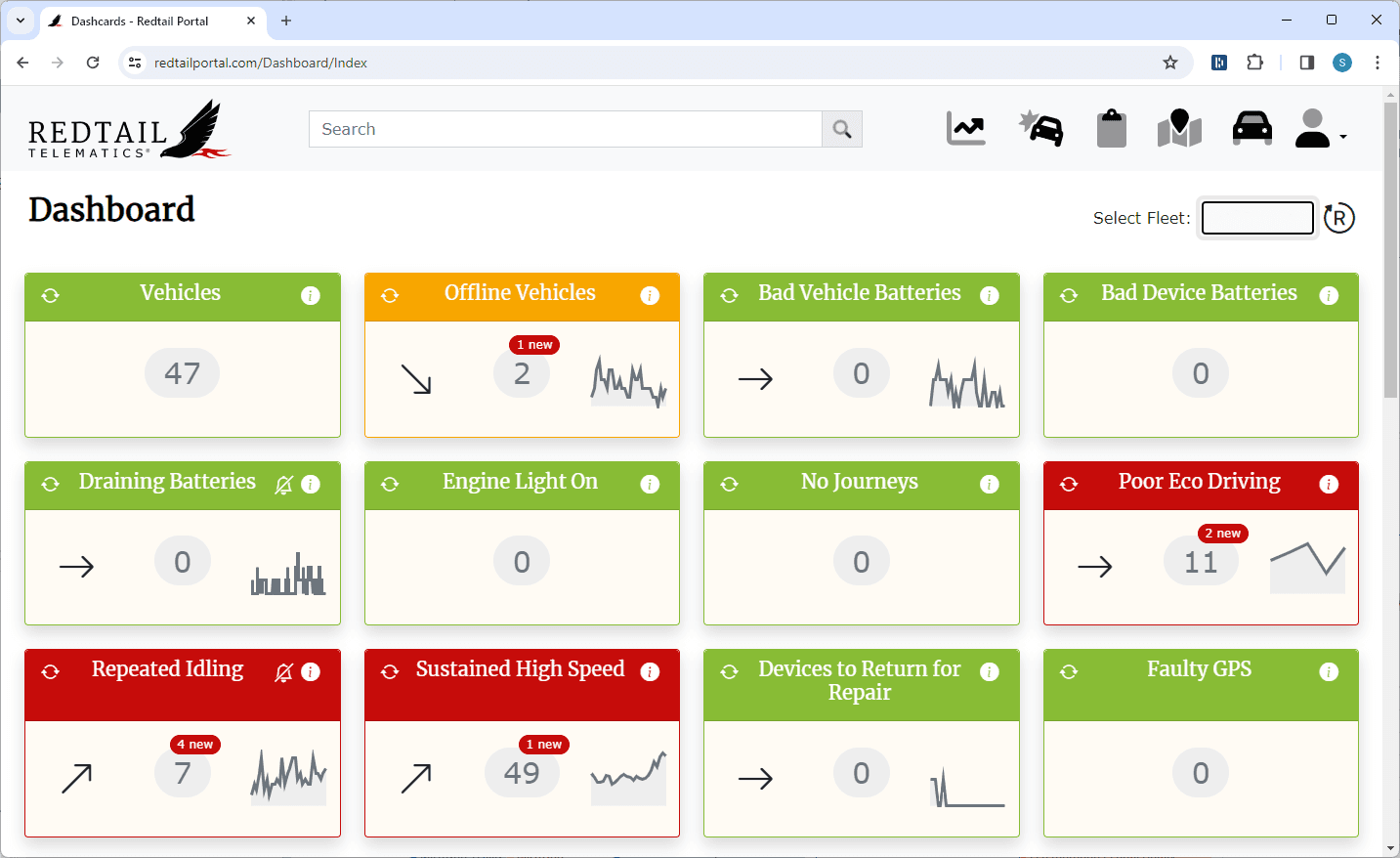

One of the biggest concerns was the insurer’s long-established workflow. They had spent years designing and refining internal processes for risk management and regulatory compliance, so we had to ensure that telematics data would slot into these systems rather than force them to start from scratch. To solve this, we built a range of export options. Key figures and summaries could be copied and pasted directly into their existing claims platform. More complex data could be turned into PDF reports, which the insurer could attach to relevant files. We even created small “dashcards” of concise, visual information, which could be dropped into their dashboards without extra training or software changes.

The end result was a system that not only sped up the detection of accidents but also provided immediate, reliable details to help the insurer see exactly what happened. Because this information could be used alongside their tried-and-tested processes, they saved time and resources while ensuring that each claim was handled in a precise, responsible way. The biggest benefit was that customers noticed a faster response from the insurer and felt more confident about how their claims were being handled.

By working with a large insurer operating on a national scale, we proved that telematics doesn’t have to disrupt what is already in place. Instead, it can strengthen existing workflows, give insurers a clearer view of every incident, and ultimately deliver a better experience for all parties involved.

Related posts

View all

Telematics car insurance – inflation busting?

Read article