Car insurance

Fairer, friendlier car insurance – an oxymoron challenged

Ever felt car insurance should be fairer and friendlier? Ever considered or tried telematics based car insurance? If not, you should - here's why!

Andrew Little

Share

On this page

- Car insurance – could telematics be the answer to fairer and friendlier options?

- Change needed

- Just 4% of our sample have received any communication from insurers on a telematics-based car insurance policy.

- Our survey also revealed an absence of awareness and education on telematics data on car insurance.

- By way of a conclusion, and without wishing to be hectoring, let’s imagine how that conversation goes:

Car insurance – could telematics be the answer to fairer and friendlier options?

It is broadly, if reluctantly, acknowledged that the purchase of car insurance is not the average consumer’s most pleasurable or engaging experience. A 2020 moneysavingexpert.com survey found that 38% of drivers say it’s too much hassle to change insurance provider. Feedback cites an absence of transparency, value and fairness.

The pandemic, as we all know, has exacerbated perceptions that insurers are, by and large, blind to sentiment and intent only on profit. Ah well.

Change needed

Yet, with the welcome of new rules against ‘price-walking’, January this year marked the end of higher prices for existing policyholders compared to their new counterparts. There would appear to be an opportunity to use more informed data on drivers to best effect. So we thought we’d ask two thousand UK consumers for their thoughts (for the third year running) on communication from insurers around:

- Benefits of telematics-based insurance

- Potential benefits in fairer pricing

- Improved road safety

- Environmental impacts of driving behaviour

Our results are both interesting and alarming, and undoubtedly herald opportunity. But let’s start with the headline:

Just 4% of our sample have received any communication from insurers on a telematics-based car insurance policy.

Yes that is correct: of the 2000 drivers surveyed, just 80 people had been approached to adopt a fairer, safer, more environmentally conscious policy. How so?

Let’s scrutinise a little.

Our survey also revealed an absence of awareness and education on telematics data on car insurance.

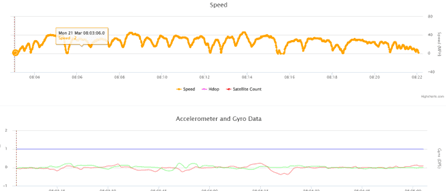

Specifically, how it can be of value for you, the consumer, in designing your policy. That data presents a view on risk – how your driving style and capability and routes impact the likelihood of you making a claim – that is more detailed, nuanced and advanced than the typical postcode/parked on/off-street deliberations.

Secondly, insurers can help you, the driver, evolve your way of driving to be safer and more emissions efficient. Lastly, in the event of a claim, there is granular data available to manage claims more fluently and fairly for all involved.

By way of a conclusion, and without wishing to be hectoring, let’s imagine how that conversation goes:

Is it so difficult? We at REDTAIL know that we can do more to educate on telematics benefits. We are utterly committed to supporting insurers and brokers with data that informs their data. Data that can offer compelling reasons for consumers to adopt the best value and fairest policies in pursuit of safer and more environmentally-friendly driving.

Related posts

View all

Telematics car insurance – inflation busting?

Read article